How to Use One-Click Trading in MetaTrader 4

Posted by | Categories: Service

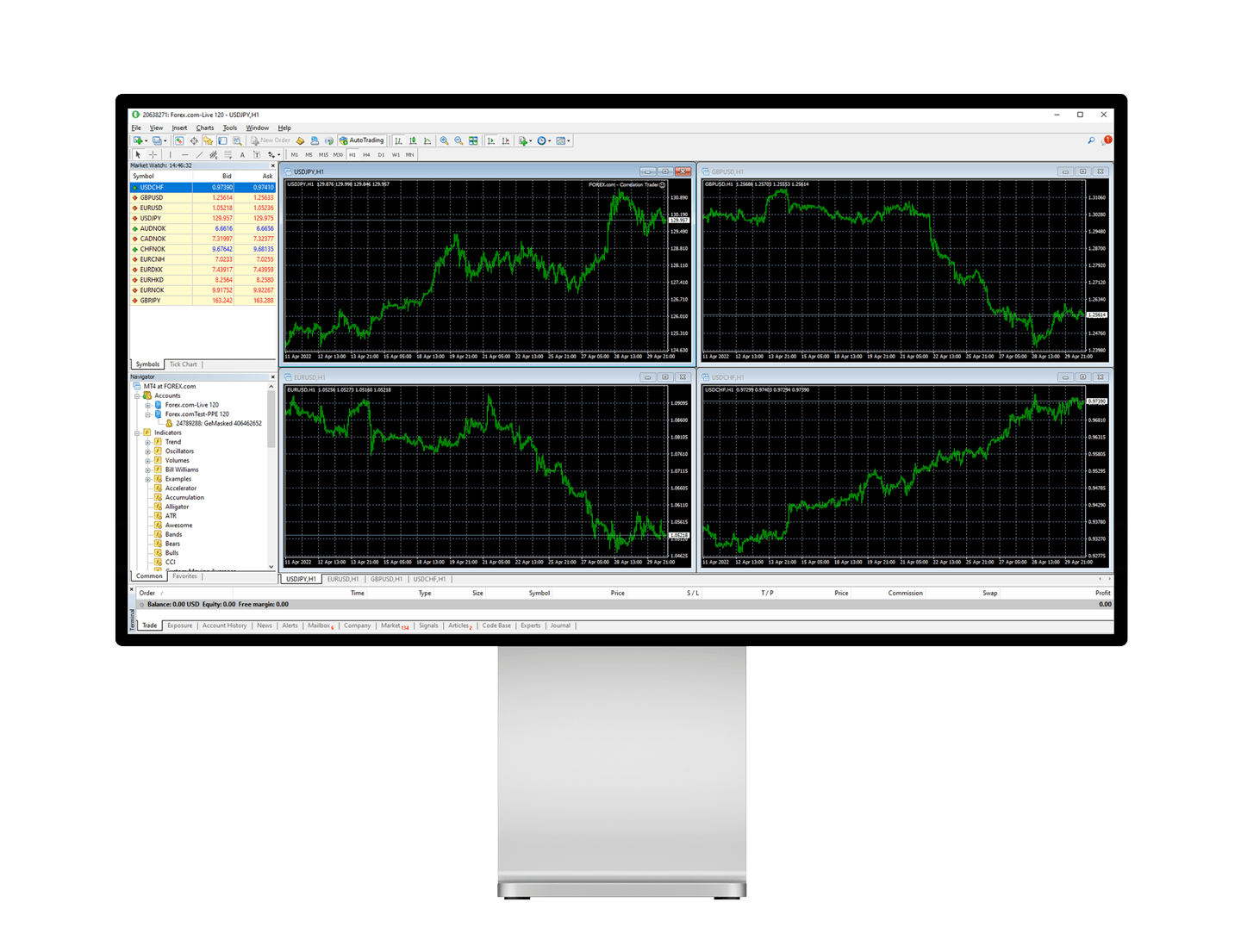

MetaTrader 4 (MT4) is a powerful trading platform widely used by forex traders around the globe. One of its most convenient features is one-click trading, which allows traders to execute trades quickly and efficiently. This feature can be a game-changer, especially in fast-moving markets where every second counts. In this article, we’ll walk you through how to use one-click trading in metatrader 4 for windows to enhance your trading experience.

What is One-Click Trading?

One-click trading simplifies the trading process by enabling you to open and close positions with a single click. This feature eliminates the need to fill out the order form, thereby speeding up the execution of trades. It’s particularly useful for traders who need to react swiftly to market movements.

Enabling One-Click Trading

Before you can use one-click trading, you need to enable it in your MT4 platform. Here’s how:

1. Open MetaTrader 4: Launch your MT4 platform and log in to your trading account.

2. Access Options: Click on ‘Tools’ in the top menu bar and select ‘Options’ from the dropdown menu.

3. Enable One-Click Trading: In the ‘Options’ window, go to the ‘Trade’ tab and check the box that says ‘One-Click Trading.’ You’ll need to agree to the terms and conditions before you can enable this feature.

4. Save Settings: Click ‘OK’ to save your settings.

Using One-Click Trading

Once you’ve enabled one-click trading, you can start using it immediately. Here’s how:

1. Open a Chart: Select the currency pair or asset you wish to trade and open its chart.

2. Activate One-Click Trading Panel: Right-click anywhere on the chart and select ‘One-Click Trading’ from the context menu. A small panel will appear in the top-left corner of the chart.

3. Execute Trades: Use the ‘Buy’ and ‘Sell’ buttons on the panel to execute trades instantly. You can also adjust the lot size directly from this panel.

Advantages of One-Click Trading

Speed

One-click trading significantly reduces the time it takes to place a trade, which can be crucial in volatile markets.

Convenience

The simplified process makes it easier for traders to manage their positions without going through multiple steps.

Improved Reaction Time

With one-click trading, you can react quickly to market changes, potentially improving your trading outcomes.

Conclusion

One-click trading in MetaTrader 4 offers a faster, more convenient way to execute trades. By enabling this feature, you can improve your reaction time and take advantage of market opportunities as they arise. Whether you’re a seasoned trader or just starting, one-click trading can streamline your trading process and enhance your overall experience.

Enable one-click trading today and experience the benefits for yourself!

CFDs Unveiled: A Deep Dive into Trading Contracts

Posted by | Categories: Service

Contracts for Difference, or CFDs, have become increasingly popular among traders worldwide due to their flexibility and versatility. But what exactly what is CFDs and how do they work? Let’s delve into the fundamentals.

What are CFDs?

CFDs are financial derivatives that allow traders to speculate on the price movements of various financial assets without owning the underlying asset itself. These assets can include stocks, indices, commodities, currencies, and more. Instead of purchasing the asset outright, traders enter into a contract with a broker to exchange the difference in the asset’s price between the opening and closing of the contract.

How do CFDs work?

When trading CFDs, traders choose whether to go long (buy) or short (sell) based on their prediction of the asset’s price movement. If they anticipate that the price will rise, they open a long position; if they expect it to fall, they open a short position.

Key Features of CFDs

Leverage: CFDs offer flexible leverage, allowing traders to amplify their potential returns by controlling a large position with a relatively small amount of capital. However, it’s essential to manage leverage carefully, as it also increases the potential for losses.

No Ownership: Unlike traditional investing, where you own the underlying asset, trading CFDs involves only speculating on price movements. This means traders can profit from both rising and falling markets.

Range of Assets: CFDs provide access to a wide range of financial markets, enabling traders to diversify their portfolios and take advantage of various opportunities across different asset classes.

Short Selling: CFDs allow traders to profit from falling prices by selling assets they don’t own, known as short selling. This flexibility enables traders to capitalize on bearish market conditions.

Cost-Effective: Trading CFDs typically involves lower costs compared to traditional trading, with no stamp duty or exchange fees. However, traders should be mindful of spreads, overnight financing charges, and other associated costs.

Risks of Trading CFDs

While CFDs offer several advantages, they also come with inherent risks:

Leverage Risk: While flexible leverage can amplify profits, it also increases the potential for significant losses.

Market Risk: CFD prices are derived from the underlying asset’s price, making them susceptible to market volatility and sudden price movements.

Counterparty Risk: Trading CFDs involves entering into a contract with a broker, exposing traders to the risk of the broker’s financial stability.

Conclusion

CFDs are powerful financial instruments that offer traders the opportunity to speculate on various markets with flexibility and efficiency. However, it’s crucial to understand the risks involved and employ appropriate risk management strategies. By gaining a comprehensive understanding of CFDs and practicing disciplined trading, individuals can harness their potential for profit while minimizing risks.